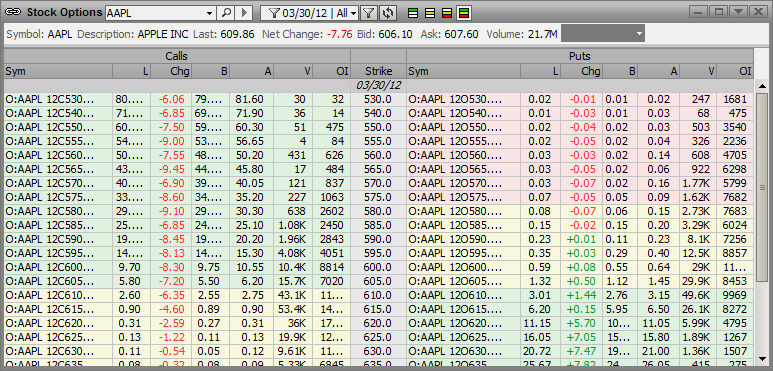

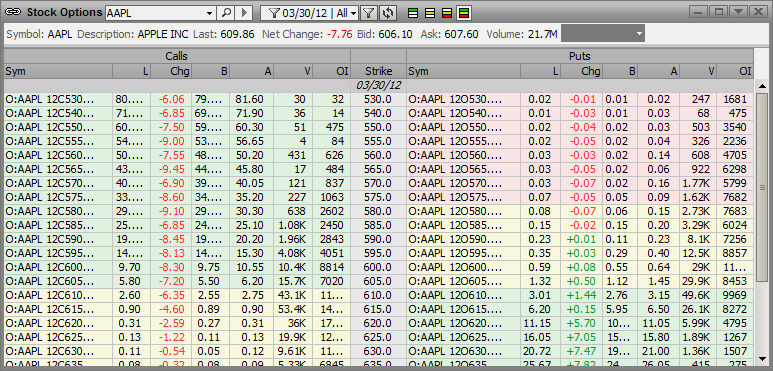

For an underlying security, the option chain shows the various strike prices by put and call designations, as well as expiry dates. The strike price field is bracketed by either a red line on the left or a green line on the right. The current price is found in the cell where the two lines meet.

It is possible to customize the table by adding or subtracting columns and also to arrange the column order.

Users can add window options, manage alerts, change the headings to default to those most often used with an asset class, and set the look-and-feel of the window.

Flags may also be added.

![]()

There are built in filters on the toolbar for the following:

In the Money - A call option is in the money when the strike price is below the spot price. A put option is in the money when the strike price is above the spot price.

![]()

Near the Money – a user definable number of out of the money options that are closest to being at the money.

![]()

Out of the Money - A call option is out of the money when the strike price is above the spot price. A put option is out of the money when the strike price is below the spot price.

![]()

All Strikes -removes the filters