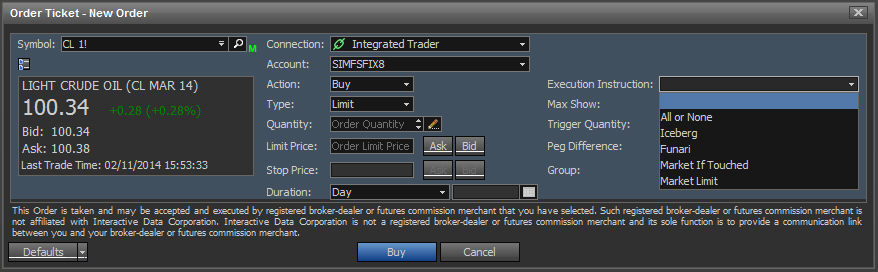

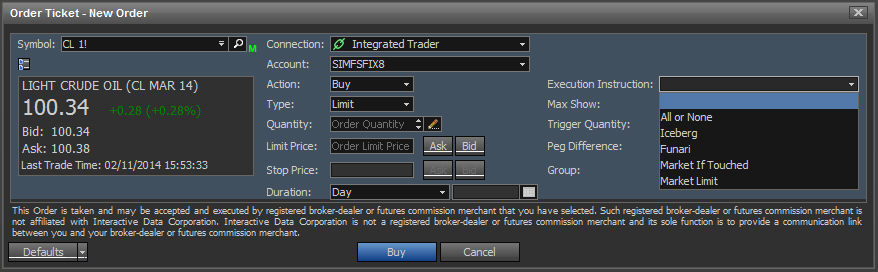

Each basic order type can become an advanced order type by selecting the Execution Instruction drop down and selecting the appropriate order type.

Please note that not all advanced order types are available to every security or contract.

Limit Order Types:

1) All or none - This option requires the order to be filled in one action, ensuring that the order isn't partially filled.

2) Iceberg - This option requires the "Max Show" field, whereas the max show is the amount displayed in market depth. Iceberg order types allow users to show a smaller portion of a larger limit order.

3) Funari - This option allows users to trade a contract as a limit order, whereas it becomes a market order on close.

4) Market if Touched - This option allows users to create a limit order that becomes a market order if any orders at that limit price gets filled.

5) Market Limit - This option allows the user to create an order that is a limit order at the best available market price.

Market Order Types:

1) All or none - This option requires the order to be filled in one action, ensuring that the order isn't partially filled.

Stop Order Types:

1) All or none - This option requires the order to be filled in one action, ensuring that the order isn't partially filled.

2) Quantity Triggered Stop - This option requires a "Trigger Quantity" to be reached to be filled, such that any trades below a certain threshold at the stop price will not trigger the stop.

3) Market if Touched - This option allows users to create a stop order that becomes a market order if any orders at that price gets filled.

4) Trailing - This option allows the user to create a trailing stop. Set the "Peg Difference" to set the distance away from the last for the stop to trail.